Navigating the American dream: Your guide to buying land in the USA

The allure of owning a piece of the American landscape, a tangible slice of the earth, is a dream deeply embedded in the national psyche. Whether it’s a sprawling ranch in Montana, a secluded cabin site in the Appalachian Mountains, a beachfront property in Florida, or a buildable lot in a burgeoning suburban community, buying land offers a unique sense of freedom and possibility. But navigating the complexities of the American real estate market, especially when it comes to undeveloped land, requires careful planning, diligent research, and a thorough understanding of the process. This guide aims to provide a comprehensive overview of buying land in the USA, empowering you with the knowledge to make informed decisions and realize your land ownership aspirations.

Why buy land? Understanding your motivations

Before diving into the specifics of the buying process, it’s crucial to clarify your reasons for wanting to purchase land. Your motivations will significantly influence the type of land you seek, its location, and the associated costs. Consider these common reasons:

- Building a home: This is perhaps the most frequent reason. Owning land allows you to custom-design your dream home, precisely tailoring it to your needs and preferences, free from the constraints of pre-existing structures.

- Investment: Land can be a valuable long-term investment, particularly in areas experiencing growth and development. Appreciation in land value can provide substantial returns over time.

- Recreation: Many people purchase land for recreational purposes, such as hunting, fishing, camping, hiking, or simply enjoying the tranquility of nature.

- Farming or ranching: Agricultural land offers opportunities for cultivating crops, raising livestock, or establishing a sustainable homestead.

- Future development: Some buyers acquire land with the intention of subdividing and developing it in the future, potentially generating significant profit.

- Preservation: A growing number of individuals are purchasing land to protect it from development, preserving natural habitats and contributing to conservation efforts.

The crucial first step: Due diligence

Once you’ve defined your objectives, the most critical phase begins: due diligence. This involves thorough research and investigation to ensure the land you’re considering meets your needs and doesn’t harbor any hidden liabilities. Never skip this step, no matter how tempting the deal may seem.

Zoning and land use regulations

Every parcel of land in the USA is subject to zoning regulations, which dictate how the land can be used. These regulations are established and enforced by local governments (city, county, or township). Before making an offer, verify the zoning designation of the property and ensure it aligns with your intended use. Common zoning categories include:

- Residential: Allows for the construction of single-family homes, multi-family dwellings, or mobile homes. Subcategories may specify density restrictions (e.g., minimum lot size).

- Commercial: Permits various business activities, such as retail stores, offices, or restaurants.

- Industrial: Designated for manufacturing, warehousing, or other industrial operations.

- Agricultural: Allows for farming, ranching, and related activities.

- Mixed-use: Combines different zoning categories, often seen in urban areas.

- Conservation/Preservation: Restricts development to protect natural resources or environmentally sensitive areas.

Contact the local zoning department or planning commission to obtain the zoning information for the specific parcel. Be aware that zoning regulations can change, so it’s wise to inquire about any proposed or pending zoning amendments that could affect the property.

Access and utilities

Physical access to the land is paramount. Does the property have legal access via a public road or a recorded easement? An easement grants the right to use another person’s land for a specific purpose, such as access. Landlocked parcels, without legal access, can be significantly devalued and difficult to develop. Verify the existence and validity of any claimed easements through a title search.

Equally important is the availability of utilities:

- Water: Is there access to a public water supply, or will you need to drill a well? If a well is required, investigate the depth and quality of groundwater in the area.

- Sewer/Septic: Is the property connected to a public sewer system, or will you need to install a septic system? Septic systems require a percolation test (“perc test”) to determine the soil’s suitability for wastewater absorption.

- Electricity: Is electrical service readily available, or will you need to pay for an extension from the nearest power line?

- Gas: If natural gas is desired, check for availability and connection costs.

- Internet/Phone: Determine the availability and reliability of internet and phone service, especially in rural areas.

The cost of extending utilities to a remote property can be substantial, so factor these expenses into your budget.

Environmental considerations

Conduct a thorough environmental assessment to identify any potential hazards or liabilities. These may include:

- Wetlands: Federal and state regulations protect wetlands, which may restrict development on portions of the property. A wetland delineation survey may be necessary.

- Floodplains: If the property is located in a designated floodplain, building restrictions and flood insurance requirements may apply.

- Endangered species: The presence of endangered or threatened species can trigger development restrictions under the Endangered Species Act.

- Soil contamination: Past industrial or agricultural activities may have contaminated the soil with hazardous substances. A Phase I Environmental Site Assessment can identify potential contamination.

- Radon: This naturally occurring radioactive gas can seep into homes and pose health risks. Radon testing is recommended, especially in areas with known radon concerns.

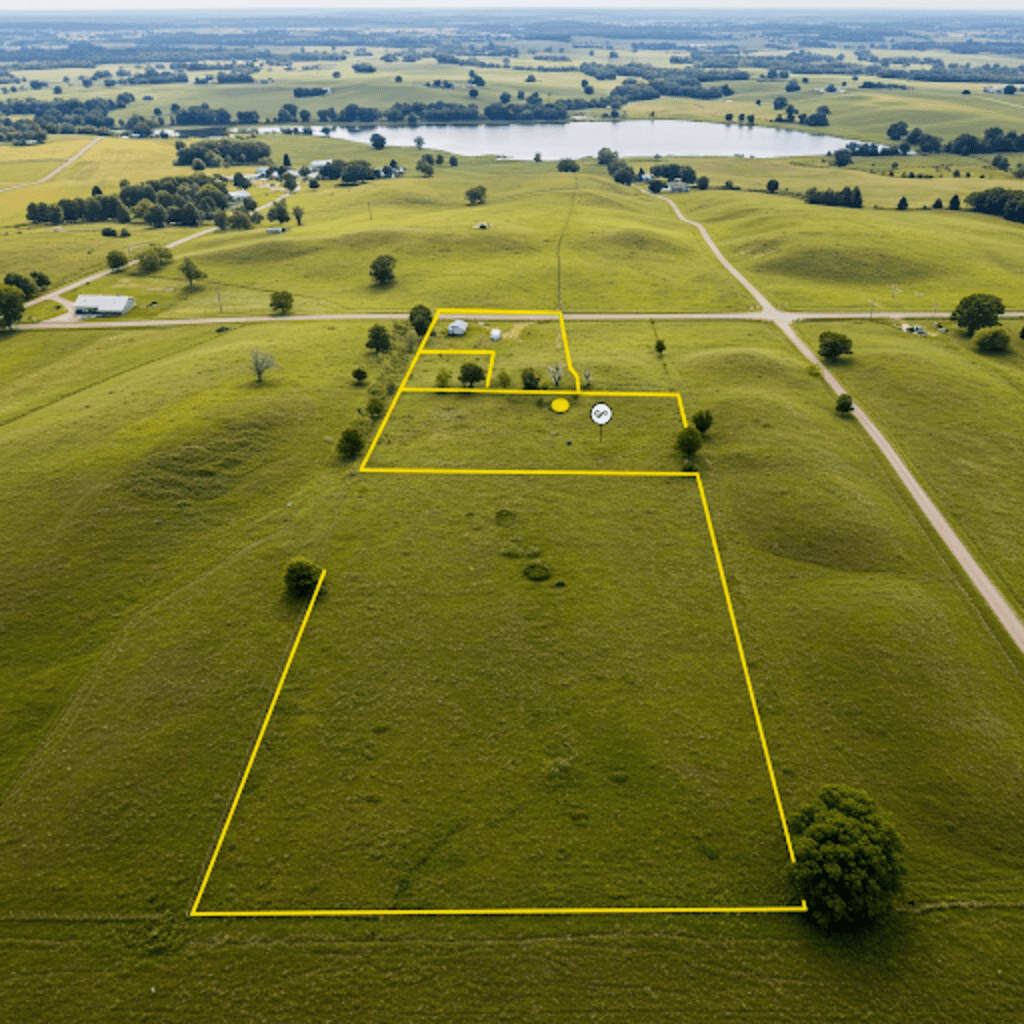

Surveys and title search

A professional land survey is essential to determine the precise boundaries of the property, identify any encroachments (structures or improvements extending onto neighboring land), and confirm the acreage. The survey should be performed by a licensed surveyor.

A title search, conducted by a title company or attorney, examines the history of the property’s ownership to ensure there are no outstanding liens, judgments, or other claims that could affect your ownership rights. Title insurance protects you against financial losses arising from title defects.

Financing your land purchase

Securing financing for land can be more challenging than obtaining a mortgage for an existing home. Lenders often view land loans as riskier, as there is no immediate collateral in the form of a building. Common financing options include:

- Land loans: These loans are specifically designed for purchasing undeveloped land. They typically require a larger down payment (20-50%) and may have higher interest rates than traditional mortgages.

- Construction loans: If you plan to build immediately, a construction loan can finance both the land purchase and the construction costs. These loans typically convert to a traditional mortgage upon completion of the building.

- Seller financing: In some cases, the seller may be willing to finance a portion of the purchase price. This can be a viable option if you have difficulty obtaining traditional financing.

- Home equity loan or line of credit: If you own a home with sufficient equity, you may be able to borrow against it to finance the land purchase.

- Personal loans: Personal loans can be used for any purpose, including buying land, but they typically have higher interest rates than secured loans.

Shop around for the best loan terms and compare interest rates, fees, and down payment requirements.

Making an offer and closing the deal

Once you’ve completed your due diligence and secured financing, you’re ready to make an offer. Work with a real estate agent experienced in land transactions to help you negotiate the price and terms of the purchase agreement. The offer should include contingencies, such as a satisfactory inspection, financing approval, and a clear title.

If the offer is accepted, the closing process begins. This involves signing the final documents, transferring funds, and recording the deed with the county recorder’s office. A closing attorney or escrow company typically handles the closing process.

Additional Considerations:

- Property Taxes: Research the annual property taxes.

- Homeowners Associations (HOAs): If the land is part of a development, check for HOA fees and regulations.

- Mineral Rights: Determine if mineral rights are included with the property, and if not, who owns them.

- Timber Rights: If there are valuable trees on the property, investigate timber rights.

- Local Expertise: Working with a real estate agent, attorney, and surveyor who specialize in land transactions in the specific area is highly recommended. They can provide invaluable local knowledge and guidance.

The ongoing responsibilities of land ownership

Owning land comes with ongoing responsibilities, including:

- Property taxes: Paying property taxes on time is crucial to avoid liens or foreclosure.

- Maintenance: Maintaining the property, such as mowing grass, clearing brush, and controlling weeds, may be required by local ordinances or HOAs.

- Liability: As a landowner, you have a legal responsibility to maintain your property in a safe condition to prevent injuries to others.

- Insurance: Consider obtaining liability insurance to protect yourself from potential lawsuits.

Buying land in the USA can be a rewarding experience, offering the opportunity to build a dream, create a legacy, or simply enjoy the beauty and freedom of the American landscape. By understanding the process, conducting thorough research, and seeking expert advice, you can navigate the complexities of the market and make your land ownership dreams a reality.